Equipment Financing: Get the Tools You Need to Grow

EQUIPMENT FINANCING

Equipment financing is a crucial tool for businesses looking to acquire the necessary tools and technologies to stay competitive in today's fast-paced market. By opting for equipment financing, companies can access the latest equipment without the burden of making large upfront payments. Whether it's advanced machinery, high-quality computers, or specialized tools, this financing option allows businesses to conserve their capital and allocate resources to other critical areas of operations.

Equipment financing also offers flexibility in terms of payment options, allowing businesses to choose a convenient repayment schedule that suits their cash flow. With the growing importance of technology and equipment in almost every industry, equipment financing has become an indispensable resource for businesses seeking to stay at the forefront of innovation. This financing is based on the value of the equipment and the business's ability to make payments, which often makes it easier to qualify for than other types of loans.

Types of Equipment You Can Finance

Our equipment financing program is designed to be flexible and can be used to acquire a wide range of new or used equipment across various industries. Some common examples include:

Construction

Excavators, bulldozers, cranes, dump trucks, and other heavy machinery.

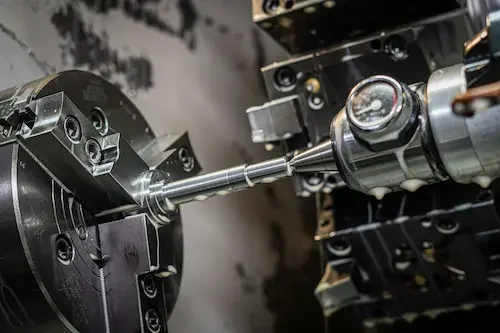

MAnufacturing

CNC machines, 3D printers, assembly line robots, and other production equipment.

restaurants

Commercial ovens, refrigerators, POS systems, and other kitchen equipment.

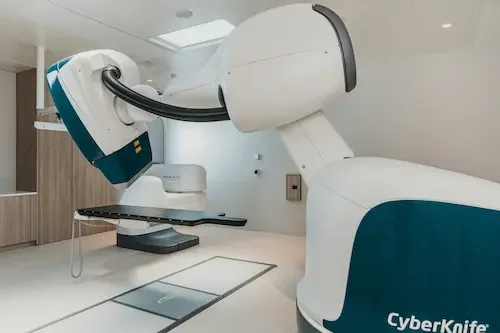

Medical & Dental

X-ray machines, dental chairs, diagnostic equipment, and other medical devices.

IT & Technology

Servers, computers, networking hardware, and other tech infrastructure.

Transportation

Commercial trucks, trailers, delivery vans, and other vehicles.

Equipment Financing vs. Leasing

Choosing between financing and leasing depends on your business's long-term goals. Here’s a comparison to help you decide:

Equipment Financing

You own the equipment at the end of the term.

Equipment Leasing

You do not own the equipment; you are renting it.

Equipment Financing

Typically requires a down payment.

Equipment Leasing

Often requires a lower initial outlay.

Equipment Financing

Generally higher, as you are paying off the full value.

Equipment Leasing

Lower, as you are only paying for the depreciation.

Equipment Financing

Can be more cost-effective if you plan to use the equipment for a long time.

Equipment Leasing

Can be more expensive over time if you continually lease.

Equipment Financing

You can modify the equipment as needed.

Equipment Leasing

Modifications are generally not allowed.

Equipment Financing

You may be able to deduct the depreciation of the equipment.

Equipment Leasing

Lease payments are typically treated as an operating expense and can be fully deducted.

Expanded Qualification Details

We strive to make our qualification process as straightforward as possible. Here are more details on what we look for:

No Minimum Time in Business: Unlike many traditional lenders, we can work with startups and new businesses.

580+ FICO Score: While a higher credit score will get you better terms, we can work with scores as low as 580.

No Minimum in Annual Gross Revenue: Your eligibility is based more on the value of the equipment and your ability to make payments, rather than a strict revenue requirement.

The Equipment as Collateral: In most cases, the equipment you are financing serves as the collateral for the loan, which means you don't have to put up other business or personal assets.

Case Study: Construction Company Builds for the Future

Client: Gray Stone Construction, a growing construction firm.

Challenge: The company needed to purchase a new excavator to take on a large, profitable project. However, they didn't have the $100,000 in cash to buy the equipment outright, and a traditional bank loan would have taken too long to secure.

Solution: The company obtained a $100,000 equipment financing loan from Point Financial Solutions. The process was quick, and they were approved within a few days. The loan was structured with manageable monthly payments over a 5-year term.

Outcome: With the new excavator, the company was able to take on the new project and complete it ahead of schedule. This led to a 25% increase in annual revenue and enabled them to hire five new employees. Owning the equipment also added a valuable asset to their balance sheet.

Program highlights

BENEFITS

Monthly Payments

Multi-Year, Longer Terms

Low or NO down payment

Tax Benefits

QUALIFICATIONS

No minimum time in business

580+ FICO score

No minimum in annual gross revenue

PROGRAM FEATURES

Loan amounts $10,000-$5 Million

Terms 1-5 Years

Funding 1-5 Days